TRANSPARENT MILLENNIAL LIFESTYLE FEATURING EVERY DAY BY THE LAKE

Millennial… What does this word bring to mind for you? Do you have an image in mind of what the Millennial lifestyle is like? I wanted to create a series of interviews with bloggers sharing their lifestyle choices and financial decisions as Millennials. Just to clear things up before we get started I know there is some debate on what a Millennial is exactly. The age group that is considered a Millennial for this post is represented by anyone born between 1981 and 1996 (ages 22 to 37 in the year 2018) this is the group I am considering as Millennials.Laura was born in 1985 and is 33 years old. She states she has never had avocado toast and she is not crazy about avocados.

What do you do for a living?

That’s complicated! Right now, I am juggling two part time jobs while trying to get my freelance business off of the ground. At any given moment, you can find me recruiting for accountants, rating Facebook ads, writing freelance articles, offering up career advice or completing administrative work.I really like the variety and the fact that my work is 100% remote, with some of it able to be done on a flexible schedule.

Do you have a degree and are you currently using your degree?

I have my Bachelor’s in Psychology, my MBA and I’m currently pursuing my DBA. I think I’m using the degrees. Psychology and business knowledge is pretty universal across careers/roles.

How long have you worked in your field and what is your current salary range?

Prior to attempting to go freelance, I was in HR full time. I did that for nearly a decade. When I left my last full time HR job, I was earning 60k plus a few small bonuses and full benefits.Right now, I am earning under $1,000 per month (eek!). Thankfully, I have a good cushion in the bank and the other members of my household help with covering the bills.

Do you save for retirement and how?

I do have some money stashed in a 401k but I’m not contributing at this time because I’m living on a reduced income. I plan to start putting money aside again once my income level rises enough to cover my bills and still have a surplus.

Do you have debt? What kind of debt? What are your goals to pay off this debt?

Oh man, do I have debt. To the tune of about 300k. I owe more than 160k in student loans and about 137k on my mortgage.I’m grateful to have retired my credit card debt and car loan debt prior to leaving my full time office job.Between my current income, the assistance of my household and my savings, I have enough to cover my expenses, including my minimum debt payments, for close to a year. But, since I am working with a reduced income, I am not making extra debt payments at this time. I do plan to be more aggressive with my debt repayment once my income level rises.

Do you have or have you cancelled your home phone/cable/satellite TV?

My household does have a home phone and cable TV-- but I don’t pay for them. My guy covers that expense. I know watching TV is a huge time waster, but I do get enjoyment watching certain programs and the others in my home do, too.

What percentage of your monthly income do you save?

Now? None. But- when I was in my full time career, I saved up to 25% per month.I hope to be able to surpass that in the not too distant future.

What monthly subscriptions/memberships do use if any and why? Such as a gym membership, Blue apron, Graze, Amazon prime, Dollar shave club, etc?

I don’t think I have any monthly memberships. But—I think that’s because I typically pay yearly for a lot of things.I currently have annual subscriptions to Entrepreneur magazine, FlexJobs, The Motley Fool, Else Society & SHRM. There may be more that I am forgetting.I have these because they are helpful in terms of my career/business/finances. If the budget gets really tight, most of them can get cut.

How much do spend on groceries monthly? How often do you eat out?

My household does pretty well with our grocery spending. I know it makes me a bad personal finance blogger to not have an exact figure—but based on doing quick mental math, I’m spending about $400 per month (give or take) to feed 3 adults. This number could be improved, I’m sure. It’s on my to do list!Eating out is an Achilles heel for my budget. I don’t buy a lot of stuff anymore, but I really like to go to restaurants.Working from home has helped reduce this expense since there are multiple days per week when I don’t even leave the house. However, I’m still eating out 1-2 times per week.In a true pinch, I could easily nix this expense but it brings me joy – so it stays for now.

Do you have any passive income sources?

Well, my money market account yields about $20 per month in interest. And my 401k has increased even without contributions due to stock market gains. But that’s about it.Cultivating these passive streams is also on my to do list!

Do you own or lease a vehicle?

I own my car. I financed new in 2013 and paid it off in 2016. When the car becomes a four-wheeled paper weight, I plan to buy a used car in cash.I don’t want more debt!

Do you rent or own your own home/condo/apartment?

I bought my house in 2016. All in—principal, interest, taxes and insurance, it’s still hundreds less than renting per month. Plus, when we fix or upgrade something, it’s for our benefit—not a landlord’s!I highly recommend Laura as both a blogger and Freelance writer. Laura is incredibly personable and a great writer.You can check out Laura's previous feature on my website below:

Friends and Finances featuring Everyday by The Lake

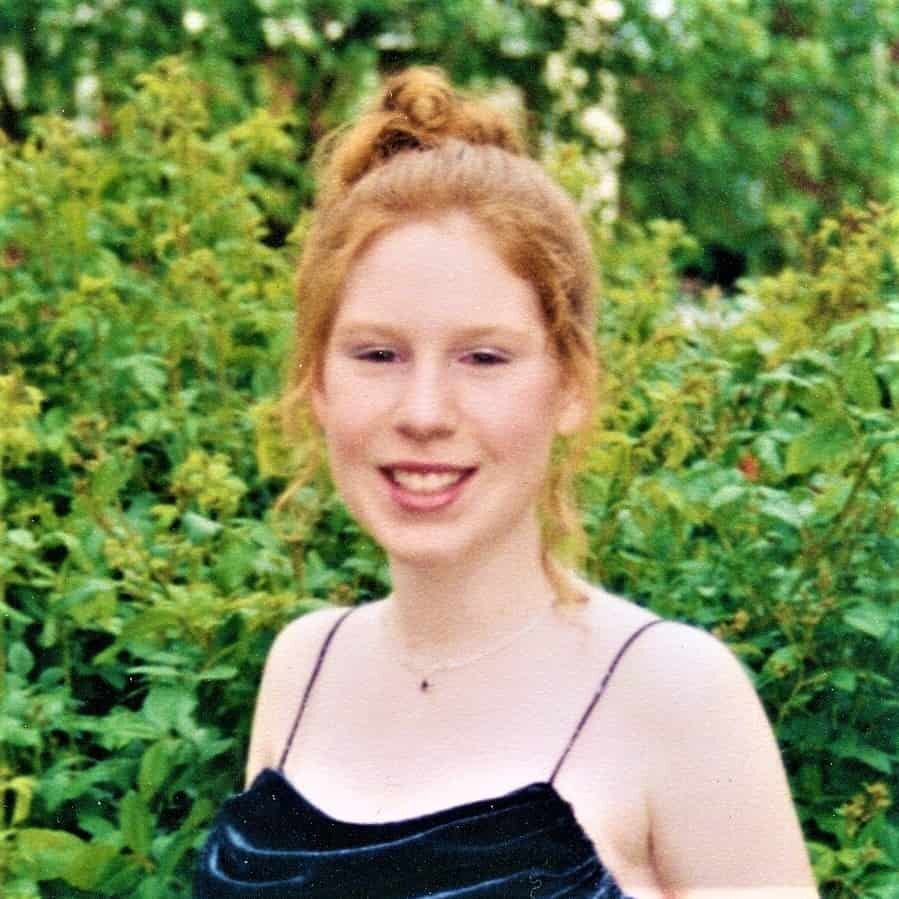

About the featured blogger

Laura Gariepy is the owner of and blogger behind Every Day by the Lake. Her blog chronicles her transition from corporate to freelance life and hopes to inspire others to pursue alternate paths that make their hearts sing. Combining her extensive HR experience, personal finance knowledge, administrative skill and writing ability, Laura offers a variety of services that can be tailored to every client. If you need a freelance writer, virtual assistant, career coach—or, just want to check out her blog, please visit: www.everydaybythelake.com.

Check out my other Millennial Interviews below: