FRIENDS AND FINANCES FEATURING XRAYVSN

Welcome back to friends and finances my featured blogger series that introduces you to some amazing bloggers. The biggest reason I decided to start this new series, is because I believe in getting different perspectives on handling your finances. I also believe that the bloggers featured here each week have a lot to offer the world and deserve recognition. Some of the blogs featured will be other personal finance related blogs and others will not be. The reason I chose to include some other blogs that are not related to finance is simple, we all have a financial story no matter who we are. I believe money is not the only focus we should have when traveling our road to financial freedom, and I think discovering some fun blogs that share something different can be a welcomed break from over focusing on money.

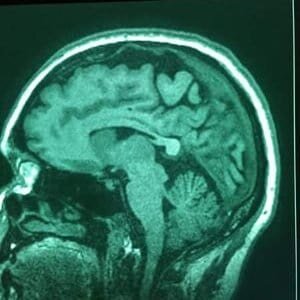

So today I welcome my favorite physician blogger from https://xrayvsn.com/

What is the goal of your blog?

I am a physician (a radiologist to be specific) and throughout my entire educational career (27 years total), not once did I have any education in finance. Physicians, as a group, are often known to be not financially savvy and often fall prey to financial scams, etc. Eventually I stumbled on some helpful blogs (Bogleheads, White Coat Investor) that allowed me to recognize I was going down the wrong path and allowed me to reverse course. This blog has a lot of my personal journey in it that I hope people can find relatable and perhaps even stop their mistakes before it can happen.

1. How long have you been blogging?

I am essentially a newbie/fledgling blogger, having just started my blog to coincide with my 47th birthday, April 23, 2018. I, probably like most people, have toyed with the idea of becoming a blogger for several years but really never took the plunge. Not sure what lit the fire but I thought if I don't do it now, I will always find an excuse to never do it. Once I committed to buying a domain I knew I had to go forward with it (it's funny how putting one's own money on the line can motivate you to take action).

2. What has been your biggest money mistake?

Where do I begin? I have so many to choose from (I have a 5 part series on my blog detailing all of them) but there is one that clearly stands out head and shoulders above the rest and that is being married to absolutely the wrong person (it was an arranged marriage and I went into it very naively). It is vital to have someone compatible not only physically and emotionally but also financially.

3. What is your best advice for recovering from or preventing this money mistake?

Anyone, at any stage of life, can recover from a financial mistake, no matter how big it is. Just know that you are not alone and that there is a good chance someone has gone through a similar situation. There is an amazing, helpful online community that will not judge you and genuinely want you to succeed. I am not going to lie, there was a point I wanted to "throw in the towel," even getting to the point where I called and told my mom the location of my life insurance policies. It really got that bad. Luckily I did find such strong support from friends and even strangers that picked me up and now I am at the best place I've ever been in my entire life.

4. Favorite quote or money advice and who was the author?

"If plan A fails, remember there are 25 more letters." --Chris Guillebeau

5. Favorite money or budgeting related book and author?

The Bogleheads' Guide to Investing- Mel Lindauer/Taylor Larimore/Michael LeBouef

6. Favorite money saving website?

https://www.whitecoatinvestor.com/classic-blog/

Not really a money saving website per se, but it is directed towards physicians and has saved me a lot of money by helping me avoid common mistakes physicians are notorious to fall victim to.

7. Favorite money making app or website?

I am a big fan of Personal Capital with its net worth tracking tool. Allows me to monitor my asset allocation easily in one place so that I can make adjustments accordingly.

8. Do you have an emergency fund or savings account?

I do have a savings account which I use as part emergency fund and part capital for any investment opportunities that arise.

9. What is your most successful strategy for saving money?

The strategy that I have turned to is investing in assets that allow a passive income stream which I hope to build an income floor in retirement. I have been investing mainly in crowdfunding real estate (RealtyShares) as well as a private syndication group that allows me to buy partial shares in multifamily commercial properties. By having a passive income stream, in case there is a downturn in the stock market, I don't have to sell shares to lock in the losses but can survive on the passive income (through dividends or real estate distributions)

I received a great bonus money saving tip from Xrayvsn and I wanted to include this tip because I think it is brilliant....

I sometimes get a nice discount from a vendor or provider of service if I ask them if they discount anything off the invoice if I pay in cash instead of using a credit card.I have had my dentist take off 2-3% off the bill if I pay in cash (which benefits him as he doesn't have to pay the credit card company any fees plus he gets immediate access to the money instead of waiting till the credit card sends payment).One of my largest discounts was when I asked the company replacing my front door if they had a better price if I paid by check instead of credit and it ended saving me over $500.00

Twitter: xrayvsn@xrayvsncom

I want to thank XRAYVSN for taking the time to be interviewed.

Thank you for sharing your insight and financial advice with all of us today. Thank you everyone who took the time to read this post, please stop by his website when you have a chance and let him know Saving Joyfully sent you. See you next time here on friends and finances for another blogger Interview, and an introduction to another great blogger.