FRIENDS AND FINANCES FEATURING EVERYDAY BY THE LAKE

Welcome back to friends and finances my featured blogger series that introduces you to some amazing bloggers. The biggest reason I decided to start this new series, is because I believe in getting different perspectives on handling your finances. Secondly I believe that the bloggers featured here each week have a lot to offer the world and deserve recognition. Some of the blogs featured will be other personal finance related blogs and others will not be. The reason I chose to include some other blogs that are not related to finance is simple, we all have a financial story no matter who we are. I believe money is not the only focus we should have when traveling our road to financial freedom, and I think discovering some fun blogs that share something different can be a welcomed break from over focusing on money.

So today I welcome Laura from www.everydaybythelake.com/Everyday by the Lake was started to chronicle my foray into semi retirement as a thirty-something. It's part personal finance, part personal growth, part lake life and part travel.

1. How long have you been blogging?

I started sometime in the fall of 2017, but really got going once I quit my full time job in Feb of this year? I had been reading about it and even bought a few domain names over the course of the past year. Once I quit my full time job, I got going with it in earnest.

2. What has been your biggest money mistake?

Using a credit card to buy jewelry-- and then having to sell the jewelry for less than what I paid so that I could make rent and eat. It was bad. It was a major part of my credit card debt issues that culminated in collections and even a court judgment against me. I'm glad that is all behind me and my credit has vastly improved since.

3. What is your best advice for recovering from or preventing this money mistake?

In terms of prevention-- just don't do it! But seriously-- learn how credit cards work before opening your first account. And really consider what you're trading away for the purchase. Not only do you need to factor in the purchase price... but there is interest, potential late fees and opportunity costs. If I buy this bauble, what will I have to give up because I can't afford to buy both? How many hours will I need to work to pay this item off? Just think about it for awhile-- it's the mindless, impulsive, instant gratification driven card swiping that really gets you.

4. Favorite quote or money advice and who was the author?

It's not money related-- but it influenced my decision to go for this semi-retirement thing: "Go confidently in the direction of your dreams. Live the life you have imagined." -Thoreau

5. Favorite money or budgeting related book and author?

I can't say enough good things about Your Money or Your Life by Vicki Robin. It is a great read for anyone interested in breaking the cycle of consumerism to pursue financial independence. The book has nine steps for achieving financial independence. While I have not followed the steps to the level of detail encouraged, I took away a couple of guiding principles that inform all of my money decisions. 1) You trade your life working for a wage to pay for your stuff. Make sure it's worth it. 2) If you spend in alignment with your real values, it will be worth it. And, once you know what you truly value, avoiding purchases that don't fall within those values becomes easier-- and empowering.

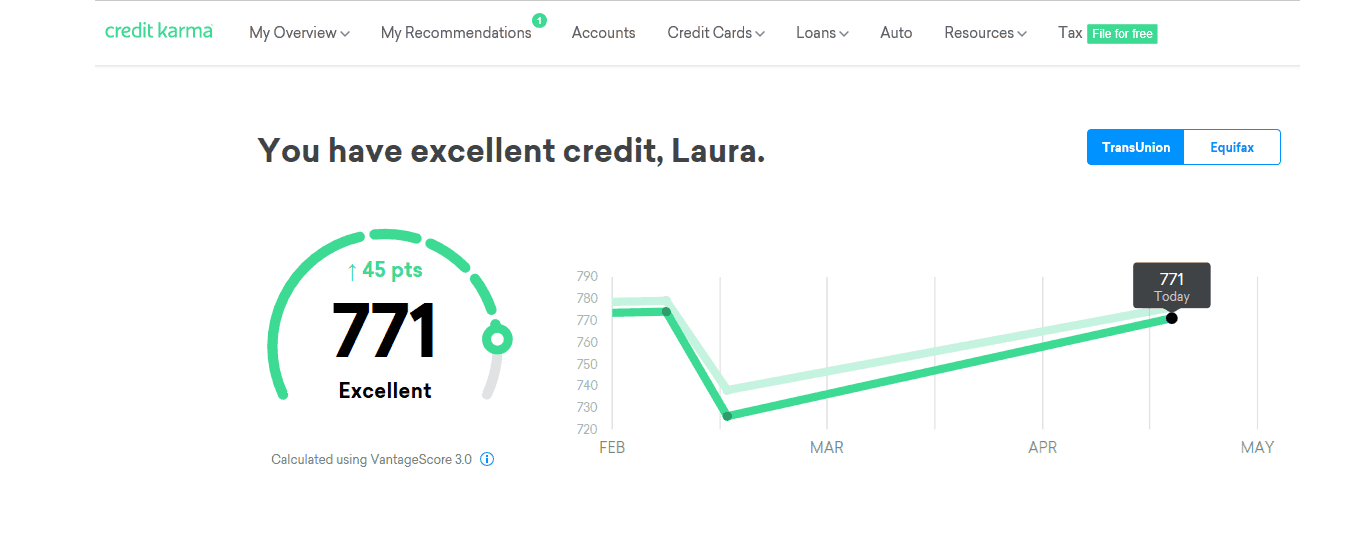

Here is a glimpse of where Laura is today with her finances check out this credit score. Great job Laura!

6. Favorite money saving website?

I really need to get with the times on this! I still use the store fliers I get in my mail to plan my shopping trips!

7. Favorite money making app or website?

Does the CapitalOne app count? I have a Money Market account with them that pays great interest as compared to traditional savings accounts. I have the app on my phone and love seeing a tank of gas worth of interest accumulate each month.

8. Do you have an emergency fund or savings account?

Yes-- well I did. I'm now living off of those savings (supplemented by part time work) since entering my semi-retirement phase.

9. What is your most successful strategy for saving money?

Stash the cash away before you can spend it! I reserved enough cash for my main living expenses (plus a little cushion) in my checking account. The rest of the money went into savings. I experimented with automated and manual savings. I think a combo of the two works well. Have a set amount automatically transfer to your savings account and then top it off manually with additional deposits as able.

Twitter (Most active here)@EverydayLake

Facebook Everydaybythelake

Pinterest Everyday by the lake

Google+ Everyday by the lake

Instagram Everyday by the lake

Website URL https://www.everydaybythelake.com

I want to thank Laura for taking the time to be Interviewed and for sharing her insight and financial advice with all of us today. Thank you everyone who took the time to read this post, stop by their website when you have a chance and let them know Saving Joyfully sent you. See you next time for another awesome blogger Interview, and an introduction to another great blogger.